Defined Benefit Plans can provide large benefits to highly compensated employees and business owners, including the ability to fund for large retirement benefits on a pre-tax basis in a relatively short period of time.

Benefit vs. Contribution – In a Profit Sharing Plan, the contribution is determined annually by the employer and the amount a participant receives at retirement depends on investment performance. In a Defined Benefit Plan, the retirement benefit is defined in the plan document and the amount funded depends on actuarial factors and assumptions.

Required Employer Contributions – Contributions to Defined Benefit Plans are not discretionary. The employer must fund a required contribution each year based on calculations made by the plan’s actuary to ensure the plan has enough funds to pay retirement benefits for employees.

Benefit Formula – A plan’s benefit formula is generally expressed in terms of a percentage of pay after a participant retires. Lump sum payment options are also permitted.

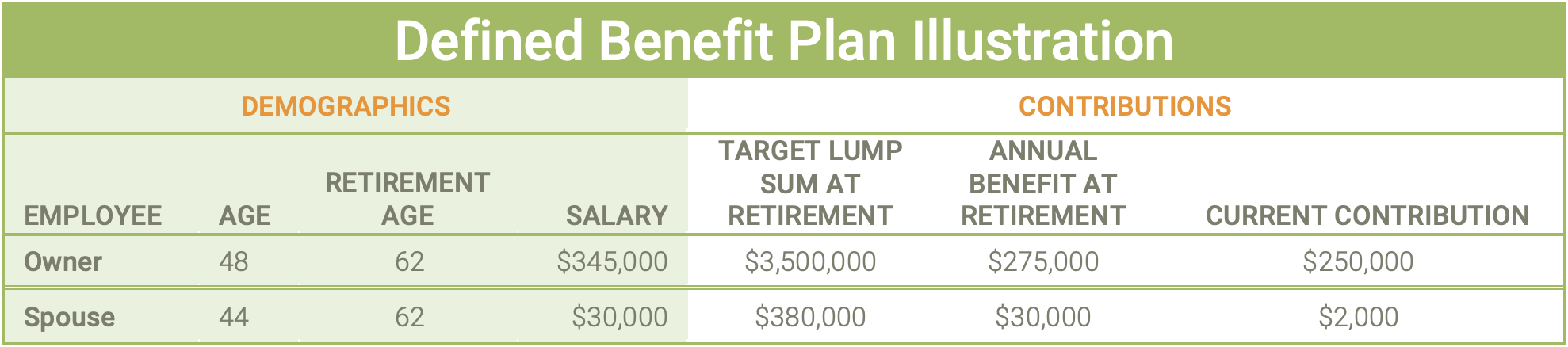

Contribution Limits – Because contributions are funded based on actuarially calculated benefits, the contribution limit is equal to the actuarially determined liability for a plan year. While the maximum individual contribution to a profit sharing plan is $69,000, contributions to a Defined Benefit Plan may be $100,000 or more.

Investment Risk – The retirement benefits in a Defined Benefit Plan are unaffected by investment gain and loss. The employer bears the investment risk of the plan. This means that contributions to the plan may fluctuate from year-to-year based on investment returns and other factors.

A Defined Benefit Plan may be a good if:

Seek Large Contributions – you seek contributions and tax deductions> $69,000.

Profitable Business – your business has strong profits and reliable cash flow.

Prepared to Contribute – you are prepared to contribute required contributions for employees each year.

Time to Catch Up – you have used cash to build your business and postponed retirement savings and you desire to contribute for five or more years.

Older Business Owners – works well for older business owners.

Learn more about Defined Benefit Plans at www.julyservices.com.