1. Room to Grow

The small business 401(k) market is underserved. For most Americans, an employer-sponsored 401(k) plan is their only source of retirement income outside of Social Security. However, many employees of smaller companies lack access to a retirement plan. According to SCORE, the smaller the business, the less likely it is to offer a retirement plan. Small business owners cite cost and lack of resources to administer the plan as reasons for not offering retirement.2 Your firm can help fill this niche area.2. Stand Out from the Crowd

Servicing small business retirement needs gives your firm wider appeal You already advise clients how to scale their business, manage cash flow and plan for business taxes. Offering small business 401(k)s can be another arrow in the quiver of ways you help clients save. And with more states mandating small business owners offer their employees a retirement plan, you will want to be able to advise employers when/if this need arises.3. Assets Add up Quickly

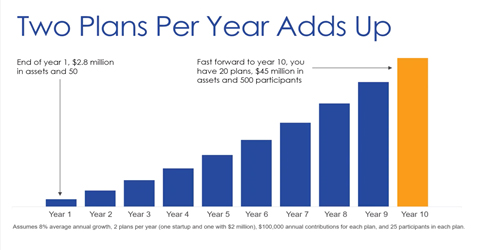

The most compelling reason to offer small business 401(k)s is that it is a dependable way to grow your assets under management and reap the advisory fees that come with them. As shown in the graph below, adding just two new retirement plans per year can add up quickly.

Offering small business 401(k)s – a product financial advisors often overlook – can help you accumulate assets and the dependable fees that come with them.

Learn more by contacting your Regional JULY Sales Director. Also, check out 5 Ways to Make Small Business 401(k)s a Key Part of Your Practice. (will link to article 18).

About JULY:

JULY is a 401(k) services company specializing in hi-touch, tech-enabled retirement plan services. Our employees have served as plan experts to advisory firms, advisor and employers in the small and micro 401(k) plan market for over 25 years. Over the last decade, our in-house software development team has built a host of proprietary technology solutions to streamline, automate and simplify all facets of retirement planning to make processes rewarding and easy for our clients. For more information about JULY, visit our website https://www.julyservices.com.

1US Small Business Administration

2https://www.score.org/resource/infographic-small-business-retirement-investing-your-future