New Comparability plans maximize retirement benefits for Highly-Compensated Employees and owners.

New Comparability Plans allow employers to make a separate contribution for different groups of employees. Groups can be created for Owners, Other Highly Compensated Employees and Non-Highly Compensated Employees. Employees can also be grouped on other criteria based on business goals. For example, companies may wish to create groups by job classification or title. Contributions made to each group are allocated among the employees in each group based on salary.

Because the Internal Revenue Code requires New Comparability Plans to pass an annual discrimination test, these plans work best for employers whose owners and highly compensated employees are older (on average) than the company’s other employees.

No. Contributions are generally discretionary, and can be increased, decreased, or even eliminated in future years, making them very flexible for employers not wishing to make a commitment to an annual contribution.

Yes. These plans can be set up as a standalone profit sharing plan (employer contributions only), or they can include a 401k feature allowing employees to make contributions.

Learn more about New Comparability Plans at www.julyservices.com.

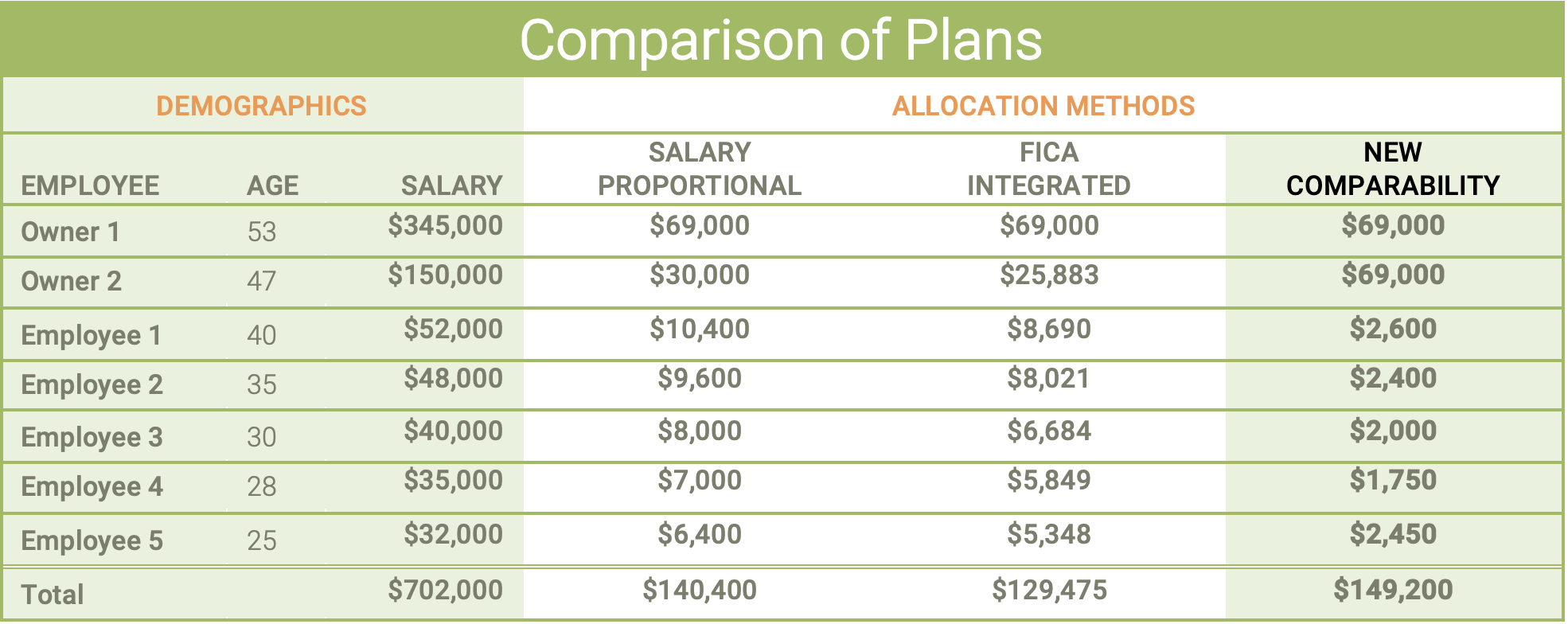

The example above illustrates the benefits of New Comparability Plans. This example shows a company with two owners and five other employees for a total of seven that are eligible to participate in the plan. The owners wanted to maximize their contributions to the retirement plan. This was accomplished through the use of New Comparability.