With a JULY Solo 401(k) Plan, sole proprietors and other owner-only businesses can take advantage of the features of a 401(k) plan.

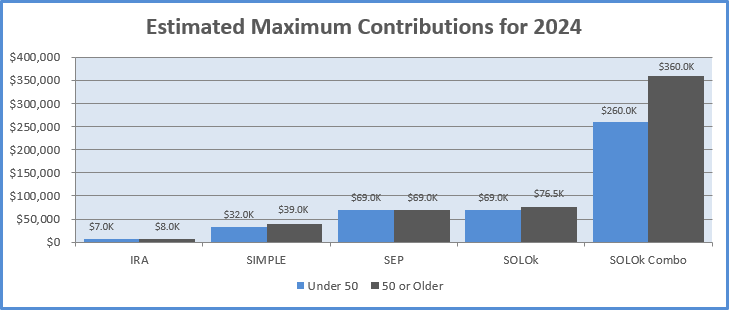

A Solo 401(k) offers a great opportunity to save for retirement while maintaining flexibility from year to year. See how it stacks up:

If you’re interested in saving more than is possible with a Solo 401(k), ask your advisor or JULY regional sales consultant for information on a cash balance plan.

Solo 401(k) plans offer important benefits:

- Flexible Contributions–Choose the contribution amount each year.

- Loans – Take loans of up to 50% of vested balances (limited to $50,000).

- Consolidation – Consolidate balances from other plans, including rollovers from IRAs, other qualified plans, and SEPs.

Owners of companies without employees may set up a Solo 401(k). Spouses may also participate.

Business Owners can contribute up to $69,000 annually, or $76,500 if age 50 or older, not to exceed 100% of the owner’s compensation. There are three types of contributions that may be funded to a Solo 401(k) Plan:

- Salary Deferrals – Pre-tax or Roth salary deferral of up to $23,000.

- Catch-up Contributions – Those age 50 or older can contribute an additional $7,500.

- Employer Contributions – Up to 25% of Earned Income.

- Establish A Plan Document – JULY will prepare a plan document which is the legal instrument that governs the plan. The document must be signed by the business owner before contributions can be funded.

- Establish Investment Account –Your plan’s investment advisor will establish the investment account. JULY will assist your advisor with this process.

- Fund Contributions – After signing the plan document and opening investment account, JULY will calculate the maximum contribution and provide funding instructions. The plan’s advisor will invest contributions.