How to Choose a Qualified Default Investment

Alternative (QDIA)

The Pension Protection Act of 2006 provided a great option for retirement plan sponsors aimed at improving participant retirement outcomes and reducing employer fiduciary liability.

Qualified Default Investment Alternatives (QDIA’s) provide safe harbor, fiduciary protection for defaulting participants in a certain investment in the absence of participant investment elections. Common situations in which default investments take effect include when employees have not completed enrollment forms or are automatically enrolled into the plan.

The following investment options satisfy the safe harbor rules and qualify for fiduciary protection.

Lifecycle or Target Retirement Date Funds are types of investments based on a participant’s age or retirement date and life expectancy and include a mix of equity and fixed income investments. They become more conservative as the participant nears retirement age. A Balanced Fund is an investment fund based on the characteristics of the group as a whole with an appropriate mix of equity and fix income investments. A Professionally Managed Account is an investment fund taking into account a participant’s individual characteristics for determining equity and fixed income allocation.

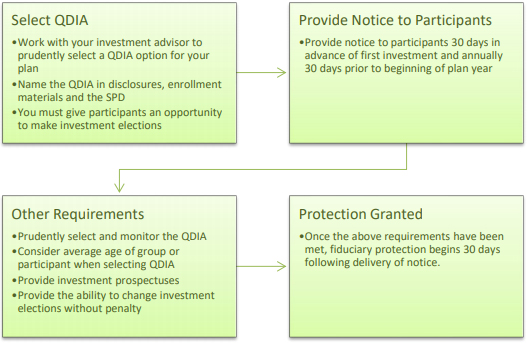

To qualify for fiduciary protection employers must select a QDIA option, provide notice to

participants, and meet several other requirements.

Described above, employers must provide notice to plan participants to receive fiduciary protection. The notice must be provided 30 days in advance of the first investment and annually 30 days prior to the beginning of the plan year. Information that must be provided in the notice includes:

- A description of the QDIA Option

- Descriptions of why a participant might be defaulted into a QDIA

- The participant’s right to direct their own investments and instructions for changing elections

- The automatic deferral percentage for automatic enrollment provisions, if applicable

JULY will assist you in complying with QDIA requirements, including creating and providing you with a QDIA Notice and making prospectuses available via the plan website. Learn more about JULY by visiting our website at www.julyservices.com.