When you participate in your employer’s retirement plan, you get to choose the investments for your account from the plan’s investment lineup. But which investments should you choose and why?

Stocks |

A stock gives investors shares of ownership in the issuing company. The value of a company’s stock will fluctuate. Historically, stocks have provided the highest potential long-term returns. However, stocks also have the greatest risk of shortterm losses. |

Bonds |

A bond is essentially a loan to a company or government for a specific period at a specific interest rate. Bonds tend to provide more modest returns than stocks, but they are generally less volatile. |

Cash |

These are short-term investments, such as money market securities, that can easily be turned into cash without losing much, if any, of their value. Considered the least risky of the three main asset classes, cash investments offer the lowest potential returns. |

How you allocate your assets among these three asset classes should reflect how long you have before you plan to retire and how comfortable you are with risk.

The longer you have before you will reach retirement, the more comfortable you may be with the risk that your investments could lose money. But, as you get closer to your retirement date, you may want to choose investments that will help you preserve the value of your portfolio.

Early in your career — When you have many working years ahead of you, you may want to consider investing a significant portion of your portfolio in stock investments to increase the potential for long-term growth.

During the middle years — At the midway point of your career, consider maintaining a portion of your portfolio in stock investments for their growth potential, since you still have time to recover from any market downturns.

Nearing retirement — As you draw closer to retirement, you may want to shift more of your investments into bond and cash investments to reduce the risk of loss and help maintain the value of your portfolio.

The asset allocation that you choose today for your plan account might not work in a few years. Regularly check your investments and adjust your asset allocation as needed.

Before you begin to invest in your company’s retirement plan, it’s important to understand your feelings toward investment risk as well as to allocate your assets in a way that best meets your retirement goals.

Complete the Risk Profile Questionnaire accompanying this guide to determine an asset allocation solution best suited to your needs. Additional calculators on risk and asset allocation can be found on the participant website.

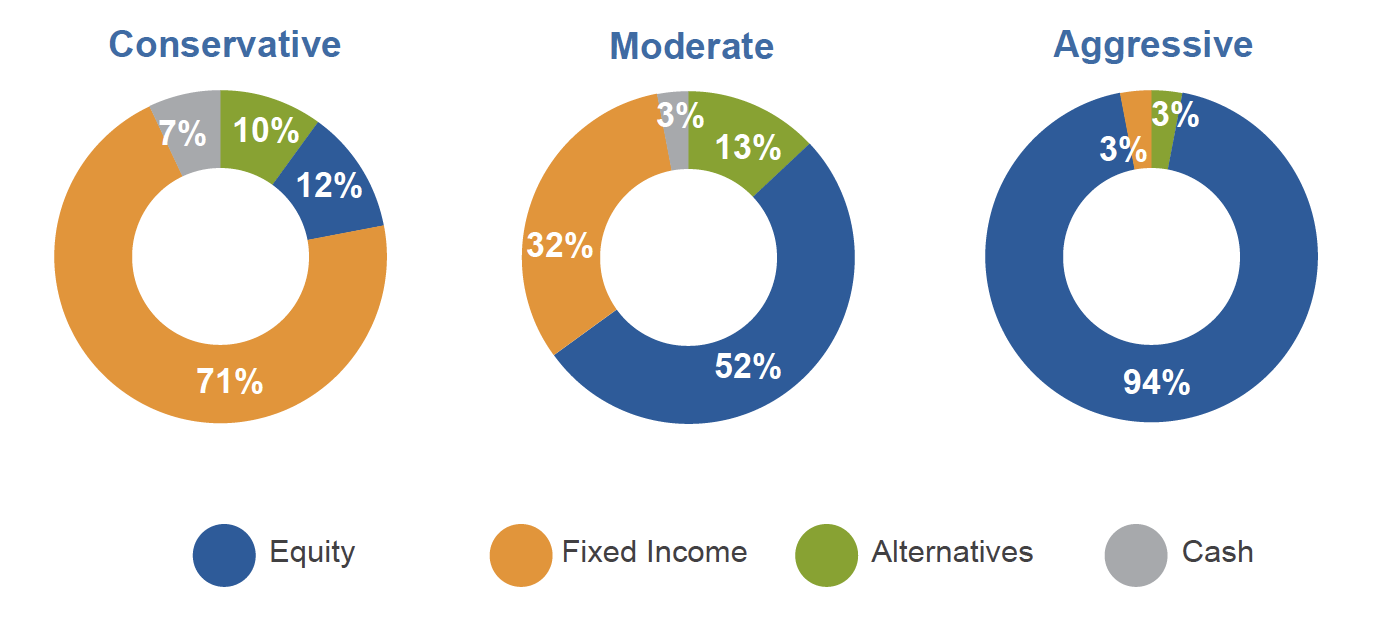

While you are encouraged to complete a Risk Profile Questionnaire to determine your unique tolerance for losing money, following are basic asset allocation recommendations for different types of investors.

Past performance is no guarantee of future results. Investments are subject to risk, and any investment strategies may lose money.

Review your investment allocation regularly to ensure your fund choices are in line with your risk comfort level, positioning you to achieve your picture of success.