When you change jobs, what should you do with the money in your former employer’s retirement plan? If you have some credit card debt or other bills you need to pay, you may be thinking about taking a cash payout. You might assume it will be easy to catch up on your savings by starting over in your new employer’s retirement plan. Right?

Wrong. Cashing out your retirement plan account can cost you — now and in the future.

First, if you cash out your retirement plan account, you’ll owe federal income taxes on the taxable portion of the distribution, which may be the entire amount.* You also might owe a 10% early withdrawal penalty, and you may have a state income-tax liability as well. After you pay the taxes and the penalty (if applicable), you could have a lot less money left to pay your bills.

Second, if you use your savings for other expenses now, you won’t have that money for your retirement. Nor will you have the potential investment returns your savings might have earned if you had kept that money invested until you’re ready to retire. Even if you start saving right away in your new employer’s plan, you probably won’t be able to make up the difference.

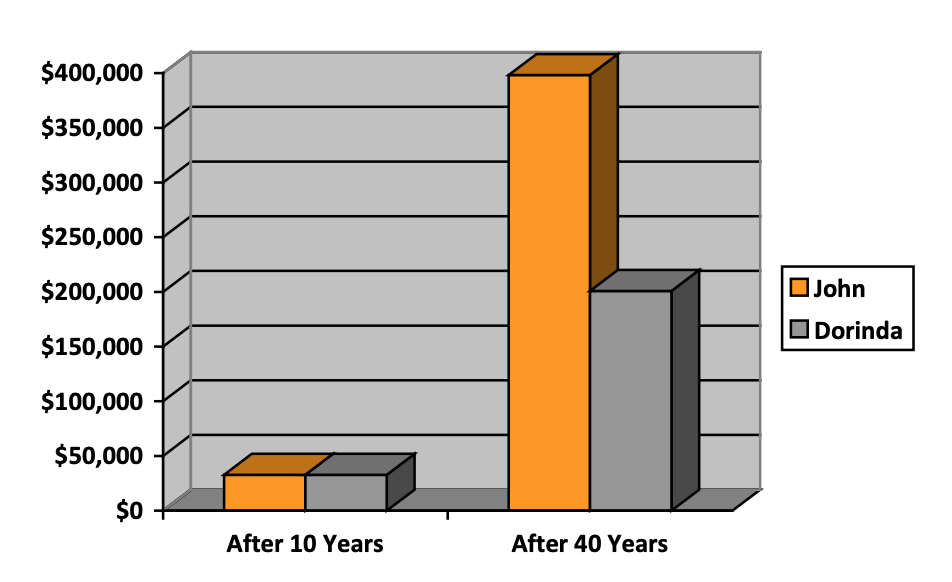

Taking a cash payout now probably means having less money for your retirement.

Instead of taking the plan money when you change jobs, you can arrange for a direct rollover from your plan account into your new employer’s qualified retirement plan or an individual retirement account (IRA). Or, just leave your money in your plan account (if allowed). Keeping all of your savings in an IRA or employer’s plan will allow your money to stay invested where it can potentially continue to grow tax deferred, helping you reach your savings goal. And, you won’t have to pay any current taxes or penalties. * Some retirement plans also offer a Roth contribution option. Unlike pretax contributions, Roth contributions do not offer immediate tax savings. However, qualified Roth distributions are not subject to federal income taxes when all requirements are met.

If you cash out your retirement savings account and spend the money, you may have much less for retirement, even if you start saving all over again in a new employer’s plan.

John arranges a direct rollover of his account balance after 10 years and continues contributions without a break. Dorinda cashes out her account after 10 years and starts saving from scratch. See the consequences of these actions on the chart below.

This is a hypothetical example used for illustrative purposes only. It is not representative of any particular investment vehicle. It assumes a monthly contribution of $200 and a 6% average annual total return compounded monthly. Your investment results will be different. Tax-deferred amounts accumulated in the plan are taxable on withdrawal, unless they represent qualified Roth distributions.

Source: DST