Joining your employer’s retirement plan is a great first step on the road to saving for retirement. But that’s just the start of your journey. Along the way, you need to periodically review the amount you’re contributing. Increasing your contribution by even a little bit can make a big difference in your account value over time.

So where do you find those extra dollars to contribute? It isn’t as hard as it may seem. You may be able to come up with additional money by taking advantage of a few of the following opportunities.

Consider earmarking a portion of any raise you receive as a contribution to your plan account. Since you haven’t been living on that money, you probably won’t miss the amount you contribute to your retirement savings.

When you pay off a loan, such as a student loan, home mortgage, or car loan, you can use the old monthly payment amount to boost your retirement contribution. Paying off a credit card balance can also free up money for your retirement account.

No one said raising a child was cheap. A middle-income family with a child born in 2015 can expect to spend about $233,610 for child-rearing expenses up to age 18.* Once your kids move out, you can use some of the money you were spending on their expenses to increase your plan contribution.

If you’re age 50 or older, and your plan permits, you may be able to increase your retirement funds by making catch-up contributions in addition to your regular plan contributions.

Another idea is to increase the percentage of pay you contribute to your plan by 1% each year. That little boost can make a difference in the amount of money you’re able to accumulate for retirement.

The sooner you start saving more for retirement, the better. Adding those few extra dollars to your retirement savings plan could make a big difference in your account value over time.

* Expenditures on Children by Families, 2015, U.S. Department of Agriculture, January 2017

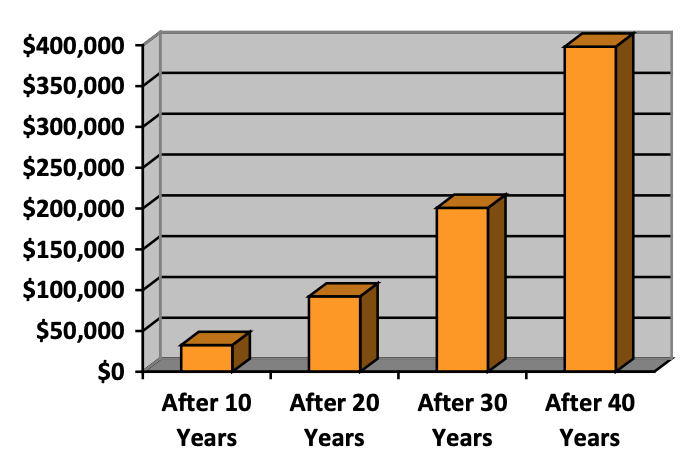

An extra $200 a month contribution could grow to:

This is a hypothetical example used for illustrative purposes only and is not representative of any particular investment vehicle. It assumes a 6% average annual total return compounded monthly. Your investment performance will differ. Tax-deferred amounts accumulated in the plan are taxable on withdrawal, unless they represent qualified Roth distributions.

Source: DST

Check out your actual cost in equivalent take-home pay in the chart below.

Federal Income Tax Rate

| Annual Pre-tax Contribution | 10% | 15% | 25% | 28% | 33% | 35% | 39.6% |

| $1,200 ($100/month) | $1,080 | $1,020 | $900 | $864 | $804 | $780 | $725 |

| $1,800 ($150/month) | $1,620 | $1,530 | $1,350 | $1,296 | $1,206 | $1,170 | $1,087 |

| $2,400 ($200/month) | $2,160 | $2,040 | $1,800 | $1,728 | $1,608 | $1,560 | $1,450 |

| $3,600 ($300/month) | $3,240 | $3,060 | $2,700 | $2,592 | $2,412 | $2,340 | $2,174 |

Source: DST