Cash Balance Plans are a great design for employers seeking to fund much larger contributions than permitted under a 401k and Profit Sharing Plan.

Type of Defined Benefit Plan – Cash Balance Plans are a type of Defined Benefit Plan, but they offer some of the best features of Defined Benefit Plans and Defined Contribution Plans.

Hypothetical Account – Participants have a hypothetical “account” that is credited with a pay credit (i.e., 5% of pay) and an interest credit (index-based).

Retirement Benefits – Are usually expressed in the form of a lifetime annuity, but lump sum payment is permitted.

Pooled Investments – Trustees make all investment decisions and generally invest in assets that track the plan’s stated interest credit.

Required Contributions – Employer contributions are required, and the annual amount is determined by an actuary. If assets are invested conservatively, contributions generally do not fluctuate widely from year-toyear as long as the plan remains adequately funded.

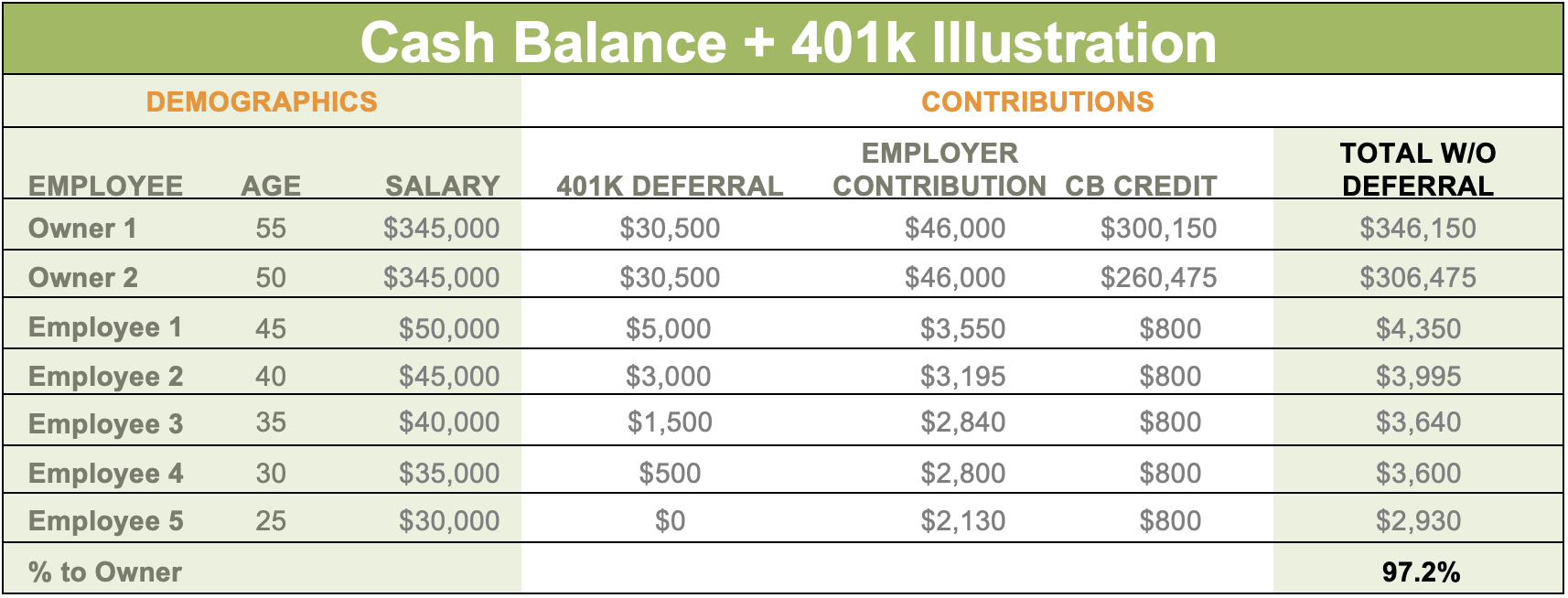

Combo Plans – A Cash Balance Plan can be paired with a 401k Plan to allow for even higher savings.

Federal Guarantee – Benefits are usually insured by the Pension Benefit Guaranty Corporation (PBGC).

A Cash Balance Plan may be a good if:

Seek Large Contributions – You seek contributions and tax deductions> $69,000.

Profitable Business – Your business has strong profits and reliable cash flow.

Prepared to Contribute – You are prepared to contribute at least 7.5% of employees’ salaries each year.

Time to Catch Up – You have used cash to build your business and postponed retirement savings.

Learn more about Cash Balance Plans.